Automotive programs today depend on precision-moulded plastic parts—dashboards, brake pedals, EV seating bases, fluid reservoirs, and more. Injection molding makes it possible to deliver these components at scale with the consistency, light weighting benefits, and design flexibility that modern vehicles demand.

For OEMs and Tier-1 suppliers, however, the stakes go well beyond production. Tooling and material costs can absorb the majority of a launch budget. Compliance frameworks such as IATF 16949 and PPAP add pressure to documentation and audit readiness. Meanwhile, EV light weighting goals, resin price swings, and increasing customer expectations around interiors and NVH performance turn injection molding into a board-level concern.

This guide offers a decision-making framework for procurement leaders and program managers who need to control cost exposure, reduce launch delays, and build resilient supply chains. It outlines the main cost drivers, decision levers, and risk factors, along with a roadmap for choosing suppliers that deliver both value and continuity.

TL;DR — Key Takeaways

Think beyond unit price: Evaluate suppliers through a Total Cost of Ownership (TCO) lens, factoring in freight, scrap, tooling rework, and compliance overhead.

DfM is risk insurance: Early supplier involvement in tooling and design prevents 4–8 week delays and accelerates PPAP approvals.

Supply resilience beats lowest bid: Multi-plant, audit-ready suppliers near OEM hubs provide a stronger hedge against disruption.

Injection moulding is a lever for differentiation: Specialized processes (two-shot, GAIM, IMD) enable light weighting, NVH improvements, and premium aesthetics that drive customer perception.

Why Injection Molding Matters Now

Injection-moulded plastics are at the center of several pressures reshaping the automotive industry. For procurement and program leaders, these pressures turn a manufacturing method into a business-critical decision area.

5 requirements: As EV adoption accelerates, every kilogram saved directly impacts range and efficiency. Replacing steel with engineered polymers can reduce component weight by up to 30% without compromising safety, making injection molding a primary enabler of OEM lightweighting goals.

Resin price volatility: Resin markets remain unpredictable, creating budgeting uncertainty and exposing programs to sudden supply shifts. While recent years have seen some normalization, procurement teams still face budgeting uncertainty tied to petrochemical markets and regional supply concentration.

Tightening compliance regimes: Standards like IATF 16949 and processes such as PPAP (Production Part Approval Process) are increasingly rigorous. Failure to meet documentation or audit requirements doesn’t just cause delays—it can halt a program entirely.

Competitive differentiation: Beyond cost control, automotive brands compete on interior aesthetics, NVH (noise, vibration, harshness), and sustainability. Injection molding processes such as two-shot molding or in-mold decoration allow OEMs to deliver these qualities efficiently at scale.

For executives, the challenge is not understanding how injection molding works—it’s about managing cost exposure, supply risk, and program timelines in an environment where mistakes carry multimillion-dollar consequences.

Automotive Injection Molding Cost Factors Every Procurement Team Must Know

For OEMs and Tier-1s, understanding the cost structure of injection-moulded parts is essential for accurate budgeting and supplier negotiations. While the unit price is the most visible figure, the true spend is shaped by several interdependent factors.

1. Tooling and Mould Development

Tooling is often the largest single upfront expense in injection molding, with individual molds ranging from thousands to well over $100,000 depending on complexity and cavitation; automakers collectively invest billions in vendor tooling each year

High-precision tools with multiple cavities, hot runner systems, or Class-A surface finishes require significant upfront investment but deliver lower per-part costs and longer tool life.

Poorly designed tools lead to rework, which can add 4–8 weeks to program timelines and inflate budgets.

2. Material Selection

Materials typically represent 45–60% of per-part cost.

Commodity resins like polypropylene (PP) and ABS are cost-efficient but subject to petrochemical price volatility.

Engineering-grade resins (nylon, PC/ABS, PBT) provide performance benefits—strength, heat resistance, electrical insulation—but add premium costs per kilogram.

Resin supply concentration also poses a procurement risk, making dual sourcing and forward contracts essential.

3. Part Complexity

Undercuts, threads, and intricate geometries require side actions, lifters, or manual inserts.

More complex designs increase cycle time, reduce yield, and drive higher tool maintenance costs.

4. Surface Finish and Aesthetics

Class-A surfaces (dashboards, bezels, decorative trims) demand polished tools, advanced texturing, or in-mould decoration.

These finishes improve aesthetics but add cost through tool preparation and quality control.

5. Production Volume and Program Lifecycle

High-volume programs justify multi-cavity, hardened steel tools that amortize cost over time.

Low-volume runs may use simpler tools, but per-part pricing remains higher due to limited economies of scale.

6. Logistics and Geography

Freight, customs duties, and plant proximity to OEM assembly hubs significantly affect the total cost of ownership.

Suppliers with plants near automotive clusters (e.g., Manesar, Sanand, Aurangabad, Faridabad, Rudrapur) reduce logistics costs and mitigate the risk of delays.

Executive takeaway: Cost control in automotive injection molding is not about chasing the lowest unit price. It requires evaluating tooling strategy, resin sourcing, supplier footprint, and lifecycle economics through a total cost of ownership (TCO) lens.

Also read: Automotive Interior & Exterior Plastic Parts Manufacturing: Trends and Innovations in 2025

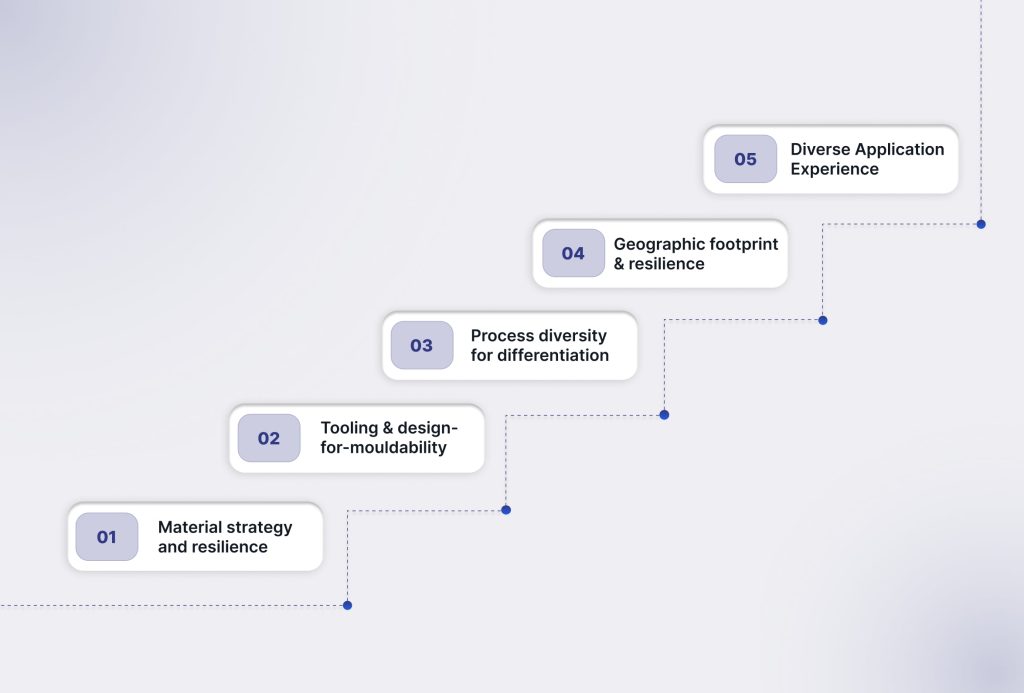

Decision Framework: Four Levers That Define Injection Molding Success

For procurement leaders, program managers, and sourcing executives, automotive injection molding decisions are best evaluated through four levers: materials, tooling, processes, and supplier capability. Each lever has a direct impact on cost, resilience, and program performance.

1. Material Strategy: Balancing Performance and Supply Risk

Why it matters: Resin selection typically accounts for half or more of total part cost. The wrong choice can either inflate budgets or expose the program to supply shocks.

Key trade-offs:

Polypropylene (PP): Lightweight, economical, widely used for bumpers and trims. Prone to volatility due to petrochemical market swings.

ABS / PC-ABS blends: Deliver premium surface finishes for interiors, but supply chains are concentrated in Asia-Pacific, creating sourcing risk.

Nylons (PA6, PA66): Essential for high-strength and fatigue-resistant parts like pedals and gears. Dependent on adiponitrile feedstocks, which have experienced periodic global shortages.

Material choice is not just an engineering decision—it is a supply chain and cost-control strategy. Dual sourcing and forward contracts help reduce risk exposure.

2. Tooling and Design-for-Mouldability (DfM): The Hidden Cost Multiplier

Why it matters: Tooling is one of the biggest risk multipliers in automotive programs and is the single most common cause of SOP delays.

Design levers:

Uniform wall thickness reduces warpage and scrap.

Draft angles and ribs improve yield and cut tool rework.

Proper tolerance planning ensures PPAP approval without rework cycles.

Embedding suppliers early in DfM reviews shortens qualification, prevents retooling, and accelerates time-to-market.

3. Process Selection: Differentiation Beyond Standard Injection

Why it matters: Not all injection molding is the same. Specialized processes can unlock lightweighting, NVH improvements, or premium aesthetics.

Examples:

Two-shot molding: Combines rigid and elastomeric materials in one part—ideal for grips, seals, and soft-touch interiors.

Gas-assisted injection (GAIM): Creates hollow sections, cutting weight in handles and panels.

In-mould decoration (IMD): Embeds graphics or textures directly during molding, reducing secondary finishing steps.

Process selection should be tied to competitive advantage, not just technical feasibility.

4. Supplier Capability: The Foundation of Resilience

Why it matters: A technically sound design fails if the supplier cannot deliver consistently, at volume, and in compliance.

Key factors to evaluate:

Certifications: IATF 16949 and PPAP readiness are baseline requirements.

Footprint: Multi-plant suppliers located near OEM hubs minimize logistics risk.

In-house R&D and tooling: Reduce reliance on outsourcing and accelerate problem-solving.

The best suppliers provide resilience, not just parts. Their ability to scale, comply, and support programs early in development is what reduces TCO and protects launches.

In short: Materials define cost exposure, tooling defines launch risk, process defines differentiation, and supplier capability defines resilience. Together, these four levers form a framework for strategic decision-making in automotive injection molding.

Risk Assessment: What Can Go Wrong in Injection Moulding Programs

1. Resin Supply and Price Volatility

Global petrochemical disruptions—such as the 2021 Texas winter storm—pushed polypropylene prices up by more than 20% within weeks, putting severe strain on automotive supply chains. The result is budget overruns and difficulty securing resin volumes, especially in high-demand EV platforms.

Mitigation: Dual sourcing, forward contracts of 12–18 months, and considering recycled or bio-based resins where viable.

2. Tooling Delays and Rework

Designs that overlook manufacturability often lead to warpage, sink marks, or tolerance failures discovered late in validation. Tool rework typically adds four to eight weeks to launch schedules and increases cost.

Mitigation: Engage suppliers early in DfM reviews and require simulation-backed validation before tooling begins.

3. Compliance and Audit Failures

IATF 16949 and PPAP frameworks are essential gates for production approval. Missing documentation or weak traceability systems can block shipments at the OEM plant. These failures risk line stoppages, escalations, and strained supplier relationships.

Mitigation: Partner with suppliers that are consistently audit-ready and have proven PPAP performance.

4. Geographic Concentration of Suppliers

Relying on a single plant or distant supplier introduces fragility. Transport bottlenecks, political instability, or natural disasters can halt deliveries and cascade into multimillion-dollar downtime.

Mitigation: Favor suppliers with multi-plant footprints close to key automotive hubs.

5. Hidden Total Cost of Ownership (TCO)

Low unit quotes often mask freight, scrap, or secondary finishing costs, which erode expected savings. Procurement teams that evaluate only piece price risk, budget surprises, and credibility loss with finance stakeholders.

Mitigation: Use a TCO approach that captures lifecycle economics, not just per-part pricing.

Injection molding risks are not just technical—they carry financial and operational consequences. Executives who anticipate and address these five areas strengthen program resilience and safeguard launch schedules.

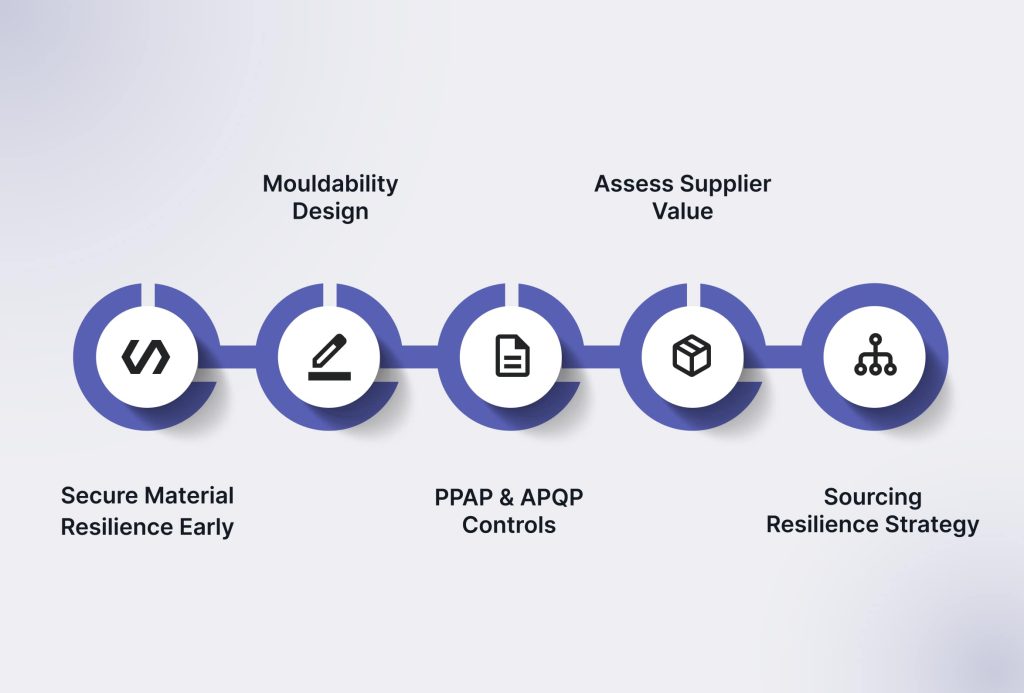

Implementation Roadmap: How Smart Procurement Teams Win

Procurement leaders succeed when they embed risk management and cost discipline into the injection molding program from the start. These five steps create a repeatable playbook for smoother launches and stronger supply chains.

1. Secure Material Resilience Early

Resins like polypropylene, ABS, and nylon account for the bulk of part cost but remain exposed to petrochemical market swings. Relying on a single source leaves programs vulnerable to shortages and sudden price spikes.

Best practice: Dual sourcing and forward resin contracts provide stability, while recycled or bio-based options can diversify supply without compromising performance.

2. Embed Design-for-Mouldability Upfront

Tooling issues are among the top causes of SOP delays. Engaging suppliers during the concept stage allows manufacturability checks before steel is cut, preventing costly rework and keeping PPAP approvals on track.

3. Treat PPAP and APQP as Risk Controls

These frameworks are more than compliance paperwork—they are insurance against audit failures and shipment rejections. Suppliers with clean audit histories and strong documentation systems reduce exposure to last-minute disruptions.

4. Evaluate Suppliers Beyond Piece Price

The lowest unit quote rarely delivers the best long-term value. Procurement teams should assess suppliers on total cost of ownership—looking at audit maturity, in-house tooling, R&D support, and scalability. This distinction often separates “good” suppliers from “great” ones.

5. Build Geographic Resilience Into Sourcing

Proximity matters. Suppliers with multiple plants near automotive hubs can respond faster to demand shifts, cut freight costs, and provide backup capacity during disruptions. This geographic spread adds resilience that single-location suppliers cannot match.

Executive takeaway: The most effective procurement teams treat injection molding as a strategic lever, not a commodity. By following this roadmap, leaders gain predictable costs, faster launches, and stronger supplier partnerships.

Strategic Injection Moulding Solutions for OEMs & Tier-1s

For OEMs and Tier-1 suppliers, the difference between a smooth SOP and a delayed launch often comes down to supplier capability. The right partner reduces the total cost of ownership, builds supply chain resilience, and keeps programs audit-ready.

JaiRaj Group has built its capabilities to align directly with the four strategic levers that matter most in automotive injection moulding:

1) Material strategy and resilience

With expertise across PP, ABS, PC/ABS, nylons, POM, TPEs, and advanced composites, JaiRaj helps OEMs balance cost, weight, and performance while managing resin volatility. In-house R&D supports rapid validation of substitutes, giving procurement teams flexibility in uncertain markets.

2) Tooling and design-for-mouldability

JaiRaj’s in-house tooling and mould development teams engage early in DfM reviews, supported by simulation. This reduces the risk of tool rework and accelerates PPAP approval, giving OEMs greater confidence in program timelines.

3) Process diversity for differentiation

From injection and blow moulding to rotational moulding, extrusion, welding, and assembly, JaiRaj offers multiple pathways under one roof. This breadth enables customers to choose the right process for each component—whether that means two-shot moulding for interiors, GAIM for lightweight structures, or in-mould decoration for premium aesthetics.

4) Geographic footprint and resilience

With facilities in Faridabad, Manesar, Aurangabad, Sanand, and Rudrapur, JaiRaj’s plants are located near India’s major automotive hubs. This geographic reach shortens lead times, reduces logistics costs, and provides backup capacity when disruptions occur.

5) Proven track record with diverse applications

Over 35 years of experience, combined with IATF 16949, ISO, and CE certifications, make JaiRaj a reliable partner for high-stakes automotive programs. Its portfolio demonstrates both technical breadth and strategic value:

For procurement leaders, JaiRaj offers more than components; it offers a partnership built on risk mitigation, cost discipline, and program continuity.

Also read: How to Choose the Right Plastic Product Supplier for Automotive & Industrial Components

Conclusion

Injection molding is one of the most critical levers in automotive manufacturing. It influences not just part cost but also launch timelines, compliance success, and supply chain resilience. For OEMs and Tier-1s managing multimillion-dollar programs, the real question is not how injection molding works but how to execute it in a way that minimizes risk and maximizes competitive advantage.

Leaders who embed material resilience, disciplined tooling practices, robust compliance frameworks, and supplier diversification into their sourcing approach achieve three outcomes consistently:

Predictable total cost of ownership by reducing hidden overruns from scrap, freight, and tooling rework.

Faster time-to-market through supplier-driven DfM and smoother PPAP approvals.

Resilient supply chains that can withstand resin volatility and geographic disruption.

If you’re planning a new program or re-sourcing existing components, connect with JaiRaj Group for a Design for Manufacturability (DfM) review or a plant visit at Manesar, Sanand, or Aurangabad.

Contact JaiRaj Group to discuss your requirements.

Frequently Asked Questions (FAQs)

1. What drives the cost of injection-moulded automotive parts?

The cost of injection-moulded automotive parts is influenced by factors such as tooling design, choice of material, part complexity, and production volume. Tooling and mould development are typically the largest upfront expenses, while resin selection and cycle time affect per-piece pricing. For procurement teams, understanding these drivers helps in forecasting budgets and controlling the total cost of ownership.

2. How does tooling design affect program timelines?

Tooling design directly impacts the timeline of an automotive program. If a part is not designed for manufacturability, it can lead to tool rework, which delays production by several weeks and adds cost. Early collaboration with suppliers through DfM reviews ensures smoother validation, faster PPAP approval, and a more reliable launch schedule.

3. When should OEMs consider specialized moulding processes?

Specialized processes like two-shot moulding, gas-assisted injection, or in-mould decoration are most valuable when they deliver performance or cost advantages over standard injection moulding. For example, two-shot moulding can combine strength and aesthetics in a single component, while gas-assisted moulding can reduce weight and improve dimensional stability. These processes should be considered when they enhance competitiveness or help meet regulatory requirements.

4. What should OEMs look for in an injection moulding supplier?

OEMs should look beyond pricing and evaluate whether a supplier has the certifications, geographic footprint, and in-house capabilities required for complex automotive programs. IATF 16949 compliance, multi-plant resilience, strong PPAP discipline, and integrated R&D and tooling are signs of a mature supplier. These attributes reduce supply chain risk and improve long-term program reliability.

5. Is dual-sourcing important for automotive injection moulding?

Dual-sourcing is an important risk mitigation strategy in automotive injection moulding. By sourcing from more than one supplier or securing multiple resin contracts, OEMs protect themselves against supply disruptions, price fluctuations, and capacity shortages. This approach strengthens supply chain resilience, ensuring that production schedules are not compromised by unexpected issues.

6. How should OEMs evaluate the total cost of ownership in injection moulding?

Total cost of ownership in injection moulding goes beyond the quoted unit price. It includes tooling investment, validation and compliance costs, logistics, supplier governance, and the risks of delays or rework. OEMs that evaluate suppliers on TCO rather than piece price alone achieve more predictable budgets, smoother launches, and better long-term value.